Microchip designer and software giant Nvidia might have been reporting a 21% decline in revenue for the fourth quarter of 2022 or some $60.5 million drop in earnings but why are its stocks outperforming other gaming and microchip manufacturers globally?

The obvious answer is the public’s interest in Artificial Intelligence.

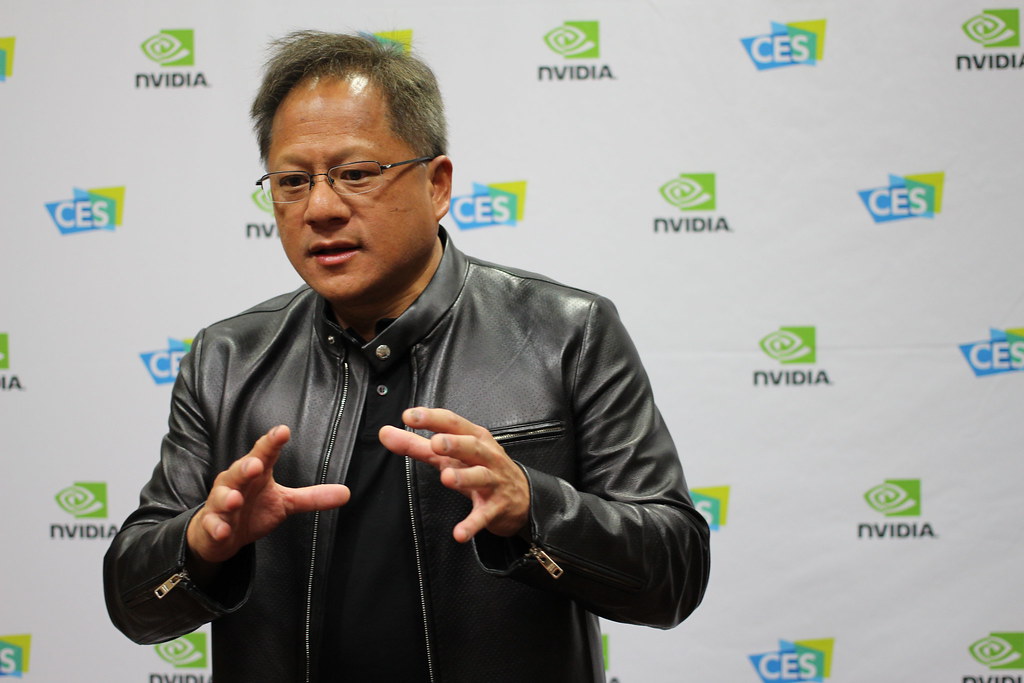

Nvidia Founder and CEO Jensen Huang remains optimistic that its early investments in AI are now coming to fruition and driving its revenues for the rest of 2023.

Huang also highlighted the potential of the company to rake in profits from the $600 billion market for AI chips as well as bank on the imagination of the public that is so enamored by the capabilities of AI technologies like ChatGPT.

“AI is at an inflection point, setting up for broad adoption reaching into every industry,” said Huang said in a company statement.

“From startups to major enterprises, we are seeing accelerated interest in the versatility and capabilities of generative AI.”

In sharp contrast to competitor Intel Corp.’s predicted loss and dividend reduction and Nvidia’s better-than-expected quarterly profits and sales estimate that topped Wall Street expectations, Huang seems to be upbeat about the cash fall expected from the growth of AI.

“We are set to help customers take advantage of breakthroughs in generative AI and large language models. Our new AI supercomputer, with H100 and its Transformer Engine and Quantum-2 networking fabric, is in full production.”

“Gaming is recovering from the post-pandemic downturn, with gamers enthusiastically embracing the new Ada architecture GPUs with AI neural rendering,” he said.

Huang’s optimism is very much reflected in the company’s conference call on Wednesday where he announced that Nvidia’s software will now be bundled with several cloud-computing products including those of popular cloud providers like Oracle, Microsoft, and Google.

As part of its AI-as-a-service offering, Nvidia also partnered with top cloud service providers to provide businesses access to its cutting-edge AI platform.

Each layer of Nvidia AI, including the AI supercomputer, acceleration library software, and pre-trained generative AI models, will also be available to customers as a cloud service.

“They will be able to interact with an Nvidia DGXTM AI supercomputer using their browser through the Nvidia DGX Cloud, which is now available on Oracle Cloud Infrastructure and will soon also be available on Microsoft Azure, Google Cloud Platform, and other clouds.”

With the continued interest in AI by many sectors, Nvidia shares are up Thursday by 12% as of midday trading, or some 59% increase in stock value this year.

As a result of the company’s foray into AI, Nvidia’s market worth has increased by more than $70 billion due to Thursday’s stock rally with a market value that now exceeds $580 billion, and is almost five times the value of its fiercest rival Intel. As a result, they are also now the seventh-largest U.S. publicly listed company.

Colette Kress, Nvidia’s executive vice president, and chief financial officer, also reported a strong Data Center revenue for the fourth quarter, up 11% from a year ago.

“Despite a reduction of sales in China, the fiscal-year increase was led by strong growth from hyperscale customers and also reflects purchases made by several CSP partners to support multi-year cloud service agreements for our new Nvidia AI cloud service offerings and our research and development activities.”

During the fourth quarter of fiscal 2022, Nvidia also returned to shareholders $1.15 billion in share repurchases and cash dividends, bringing the return in the fiscal year to $10.44 billion.

Read More Stories: How Microsoft’s AI-powered Bing could potentially change the search landscape