Qualtrics, a software company that provides an experience management platform used by notable companies like Uber, Coca-Cola, and Pfizer, has agreed to a $12.5 billion all-cash acquisition offer from Silver Lake and Canada Pension Plan Investment Board (CPP Investments). This acquisition comes two years after SAP spun off the business as an independent publicly traded company after buying it back in 2018 for $8 billion, just as Qualtrics was preparing to launch its IPO.

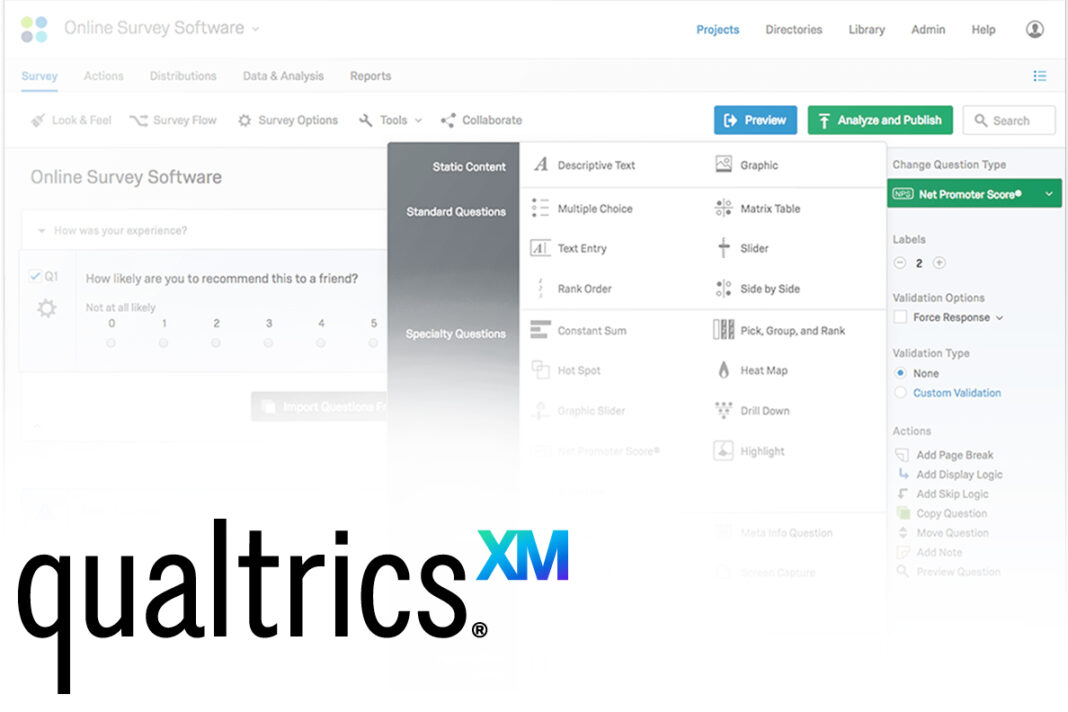

Qualtrics, founded in 2002, offers software that assists companies in gathering data and evaluating their customer experience with their products. The company’s shares traded above its $30 IPO price in its first year as a public company, but its market value has plummeted in the past year, from a high of $28 billion in early 2021 to approximately $5 billion at the end of 2022.

The $12.5 billion acquisition offer from Silver Lake and CPP Investments, financed mainly by equity commitments, appears to be an opportunistic move for a company that has been underperforming for some time. The deal has been approved by SAP’s U.S.-based subsidiary, SAP America Inc., which holds nearly 96% of the voting power via its ownership of Qualtrics’ Class A common stock, making additional shareholder approval unnecessary.

Assuming regulatory approvals, Qualtrics expects the transaction to close in the second half of 2023, following which it will be a fully private company once again, with CEO Zig Serafin continuing to lead the company, and its dual headquarters remaining in Utah and Washington.

Qualtrics, which generated $1.5 billion in annual sales last year, a 36% increase, with over 80% of those revenues coming from recurring subscriptions, invented specialized software analytics tools that assist companies in responding to their online customers. The consortium includes co-investors in Silver Lake’s funds and CPP Investments, which will provide $1.75 billion.

This acquisition is the biggest private equity buyout of the year, and Silver Lake has assembled one of the heftiest equity cheques for a private equity buyout, which lowers the financing burdens of the deal and offers financial flexibility for new growth investments. The deal culminates in a months-long negotiation as Qualtrics owner SAP worked to divest its 71% stake as part of a restructuring of the German software group.

Qualtrics’ co-founder, Ryan Smith, who sold the Utah-based software group to SAP for $8 billion in 2018 and still has a significant stake in the company, is expected to participate in the deal.