The camera company Kodak saw a 5-day stock price run-up last week, CNN reported. The stock price surged from $2.62 on Monday to $33.20 on Wednesday. The two-day rally was roughly 1,200% increase a rare sight in the pandemic hit world.

Prices increased more on Thursday when it settled at $44.44. However, prices sharply declined 20% yesterday when the news of a $756 million government loan reached the market. The loan was expected for a new pharmaceutical unit.

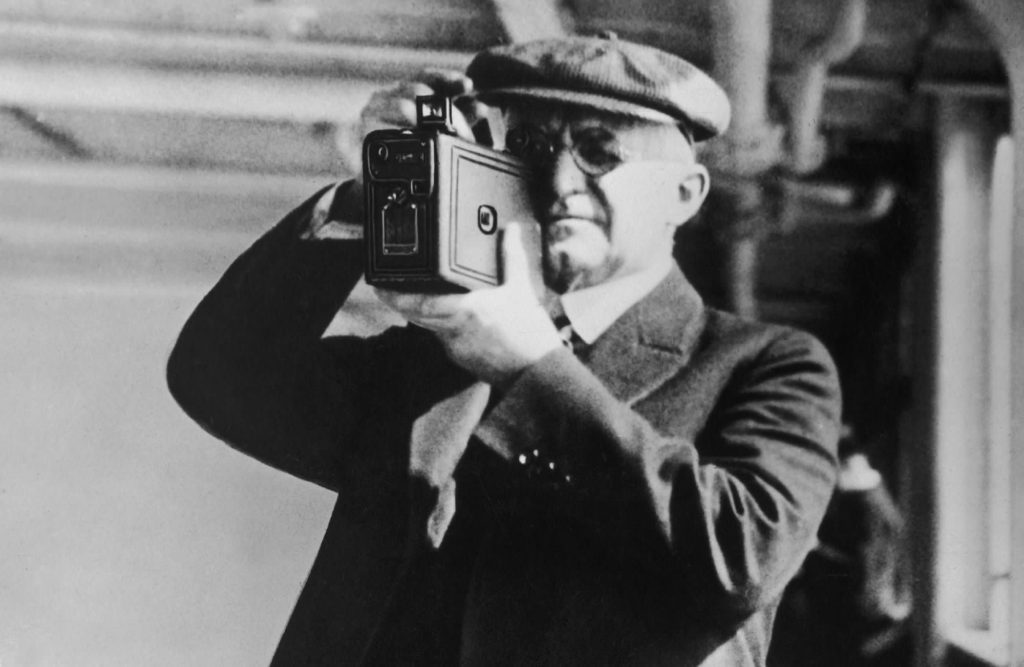

The Eastman Kodak company is globally well-known for its camera businesses. But they went bankrupt in 2012 and filed Chapter 11 for a revival.

Fortunately, Kodak revived and started expanding its business again. In 2018, Kodak launched KODAKCoin, a digital currency to join the Bitcoin craze.

According to recent studies, younger traders are found more interested in the Kodak stock. The popular investing app Robinhood has data on the strong reputation of Kodak among the short term traders. Robinhood stated that the accounts holding Kodak stocks increased 12 times in recent times.

Is it a good sign for the Investors?

In this unusual Covid situation more companies like JCPenney (JCP), Hertz (HTZ), and Diamond Offshore Drilling Inc (DO) had similar price surges for a short time. Interestingly, the price surge happened just after a Chapter 11 filing by the companies.

So we can say that Kodak followed a similar path and surged for a shorter period. But this can’t be good news for long-term investors.

Reports showed that excitement drove the trading volume from 1.6 million to 270 million in just two days. Investor guru’s think that this is a situation dominated by the short term retail investors. Hence, real investors mightn’t gain anything from this.

Moreover, there is speculation that the sugar rush might end soon as the Kodak stock is plummeting starting this week.

Read More: Ant Group Plans a Historical IPO, Seeking $200 Billion Market Value