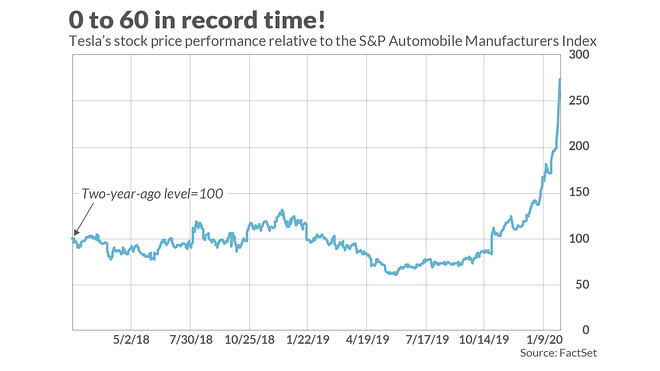

Tesla stock did great in 2020, despite the Covid-19 crisis, but market analysts are already worried about the company’s future prospects. One prominent Wall Street investment researcher actually called Tesla stock to be the biggest house of cards and ready to fold, sending shivers down the spines of investors.

According to New Constructs CEO David Trainer, even if Tesla shares went 400 percent up this year, it makes for Wall Street’s most dangerous stocks, as market fundamentals are disconnected from Tesla’s high price and valuation.

Trainer told CNBC’s “Trading Nation” on Thursday that, let us quote:

Whatever best-case scenario you want to paint for what Tesla’s going to do – whether they’re going to produce 30 million cars within the next 10 years, and get in the insurance business and have the same high margins as Toyota, the most efficient car company with scale of all-time – even if you do believe all that is true, the stock price is still implying that profits are going to be even bigger than that. We think this is a big, big – one of the biggest of all time – houses of cards that’s getting ready to fold.

David Trainer explained that Tesla’s stock price trades at 159 times forward earnings, as it’s implying anywhere from a 40% to 110% market share based upon the average selling price. The average selling price of Tesla shares is currently $57,000 and it’s based on the company selling 10.9 million car sales by 2030, which implies 42 percent market share.

Also, the recent stock split may prove to be a poisonous fruit to new Tesla investors getting into stock.

“Stock splits are inconsequential to value. They’re not changing the size, they’re just dividing it up into more pieces. Honestly, I look at the stock split as a way to lure more unsuspecting, less sophisticated traders into just trying to chase this stock up and that is not a real strategy”

After Tesla’s 5 to 1 stock split on August 31th, shares rallied 12 percent on the session. However, last week the stock ended down more than 5 percent after Tesla’s largest outside shareholder Ballie Gifford trimmed its stake, and there was also a broader sell-off of Tesla stock that seems to bring the company towards a more realistic valuation, as per Trainer’s own words.

“I think around a 10th of what it is is probably appropriate if you look at, you know, kind of a reasonable level of profits. Tesla doesn’t rank in the top 10 in market share or car sales in Europe for EVs and that’s because the laws changed in Europe that have strongly incentivized the incumbent manufacturers to crank up hybrids and electric vehicles. The same is coming in the United States. I think realistically we’re talking about something closer to $50, not $500, as a real value.”