Coronavirus pandemic forced U.S consumers to shift towards a debit card culture reducing credit card spending significantly.

The story of credit cards started in the 1950s when Diners Club introduced a new payment card. But the less popular debit card started its journey 20 years later.

As the e-commerce boom is taking place during the health crisis the credit card spending has fallen thanks to the government stimulus checks. A study by Forbes shows that consumers rejected credit cards and the debit card spending rose at the same time in 2020.

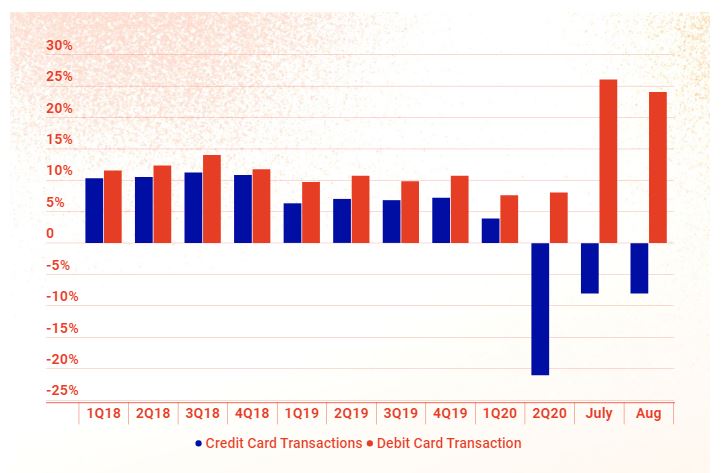

The 2nd quarter of 2020 had a significant decrease in credit card spending ever since the travel and luxury sectors came under pandemic restrictions to reduce the virus spread.

According to the data, Covid-19 lockdowns around the world created a fear among the credit card users and they chose to use debit cards only to survive in this difficult situation.

The consumer mindset has now moved towards budget items that can be purchased online using a debit card. Visa Inc, the top global credit card service provider, found credit card transactions going down 24% from the last year.

Also Read: Samsung Group Chairman Lee Kun-hee Dies at 78

However, research by MoffettNathanson suggests that debit cards went up by 10%. Many fintech companies are now offering debit cards as a medium for consumer spending.

The studies concluded that a $1,200 government-stimulus check was the main reason for such a shift in behavior. Many companies like Chime used stimulus checks as an advantage.

Once the San-Francisco based company saw an opportunity in mid-April they started to utilize it.

“Following the stimulus advance, we had the largest day for new enrollments in the history of the company”

-Chime CEO Britt.

The unemployment rate, on the other hand, had an impact on the shift towards the debit card culture. As the unemployment rates peaked at 8.4% many consumers had to give up credit cards for a less expensive payment method like a debit card.

Chime now relies entirely on a business model related to the customers swiping their debit cards. It is making a fortune not by interests but by debit card swipes.

Also Read: Britain Signs First Post-Brexit Trade Agreement with Japan