At the peak of the coronavirus pandemic, banks and other financial institutions that handle liquid cash began disinfecting and quarantining banknotes. The aim? To slow down the spread of the virus.

This practice was especially common in the Asian market, especially in China and South Korea, though several banks even in the western countries also admitted to disinfecting cash. In Thailand, for instance, the country’s central bank, Bank of Thailand, advised business, including financial institutions such as banks, to “disinfect cash by soaking in soap or dishwashing liquid for a short period.”

“The notes should then be rinsed with water before being gently dabbed with a cloth and placed under the sun to dry,” the bank said in a televised statement.

There were even warnings against using washing powder or bleach, with the bank warning that “baking or boiling money may damage the notes.”

“Wherever possible, use digital payment methods to avoid touching bank notes and coins,” the statement concluded.

It’s perhaps the clearest evidence of the impact of the covid19 pandemic on cash as a medium of exchange and a hint on where we go from here – we may be in the last days of cash as the primary medium of exchange.

What the Data Says

Before we delve into the nitty-gritty of why physical cash might be on its deathbed, let’s take a look at the data. How often are consumers still paying in cash vs. cashless options and how much has the landscape changed?

Starting in the US, figures by Andrew Maykuth of the Philadelphia Inquirer reveal that the volume of physical cash payments in circulation in the country increased swiftly at the onset of the pandemic crisis, occasioned by the crash of the financial markets. Some depositors saw the crash, panicked and withdrew large sums of money.

But, once the panic was gone, the use of physical cash slowed down dramatically. Non-cash payments, for instance, have increased 150% since March in the US.

“April was the worst month when transactions were at their lowest and public fear at the highest,” says Michael Lee, CEO of the ATM association.

Away from the US, a look at the Australian market shows the same trend. New data from the RBA (Reserve Bank of Australia) reveal that ATM withdrawals declined 30% in March and 40% in April compared to figures from last year. The drop indicates a significant reduction in cash transactions.

At the famous Mr. Donald’s store in the Brisbane suburb of Cleveland, cash transactions fell so much that cash only represented 10% of the store’s overall sales value in April, according to the Financial Review.

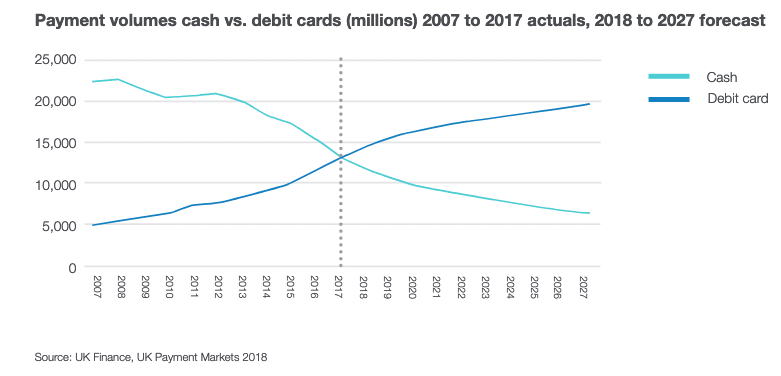

Meanwhile, in the UK, ATM transaction volumes fell as much as 62% year-over-year at the start of the country’s lockdown, according to Link which runs the country’s cash machine network. Speaking to reporters recently, Link CEO, John Howells, said the volumes have picked up over the last weeks as more businesses begin to reopen. However, he admits it doesn’t look like a “bounce back.”

“We will likely end down about 30% to 40%,” he said in the news briefing, noting that many reluctant customers are “learning to use digital alternatives” and seemingly happy with the change.

There has been a similar trend in other European nations, with the use of cash declining significantly and people instead opting to pay digitally. In Ireland, for instance, the daily value of cash withdrawals at ATMs dropped 40% after the country introduced a lockdown.

Even in countries such as Austria where consumer-facing sectors such as bars and restaurants were either not completely closed or re-opened very early, bankers say that cash volumes have not bounced back to pre-coronavirus levels.

In the same covid19 (March to April) period, Finnish consumers chose cash for only 19.1% of their daily transactions while Denmark, Norway, Sweden, and Iceland used physical cash 13.1%, 12.3%, 10.5%, and 8.4% of the time respectively.

Indeed, as in the case of the Bank of Thailand, many banks and even businesses have been encouraging consumers to use cashless payments to curb the spread of the virus.

A few facilities and businesses went as far as to refuse cash payments altogether.

That was mostly at the peak of the virus, around March and April. Since then, several economies have reopened. Those who went into lockdowns such as Spain and Italy are now back at work (albeit with strict regulations).

Early concerns about the risk of spreading the virus through the handling of notes have also been played down, with WHO making it clear that there’s “no significant risk” of catching the virus through banknotes.

However, retailers report that there’s still a reluctance among consumers to use cash. Most people are now using alternative payment solutions.

Covid19 Just the Catalyst; Cash Was Already on the Way Out

Without a proper look, you’d be forgiven to think that all this is happening because of covid19. That the world is abandoning physical cash because of the coronavirus. But, no, it’s not.

The coronavirus pandemic has played a major role in accelerating the shift to cashless payments. However, it was just that – a catalyst. A closer look reveals that cash was already on the way out as far back as 2018.

In Sweden, for instance, the pandemic struck just when the country was rolling out a plan to get rid of the Krona and replace it with a digital version, the e-krona. The Riksbank, Sweden’s central bank, had just announced the launch of a year-long pilot project of the proposed e-krona.

The project is still on. A few aspects of the trial may have been delayed or even disrupted by the pandemic, but the government of Sweden insists that the e-krona project isn’t stopping.

If successful, the e-krona will become the world’s first central bank digital currency. It could eventually be used for banking functions, including payments, deposits, and withdrawals from a digital wallet.

It’s worth noting that even before the e-krona trial, Sweden was almost a cashless country. Just 1% of the country’s GDP existed in banknotes in 2018, according to data from Riksbank.

Even today, more than half of the banks in the country don’t have physical cash in their vaults, with payments typically made through credit cards, debit cards, and mobile payment apps. In 2018, cash accounted for only 20% of all merchant transactions in the country (according to PYMNTS.com). Sweden aims to become a 100% cashless society by 2023.

And, no, it’s not just Sweden.

Two other countries, Finland and China, are also burning the midnight oil to do away with physical cash and replace the notes and coins with alternatives.

The Cashless Finland

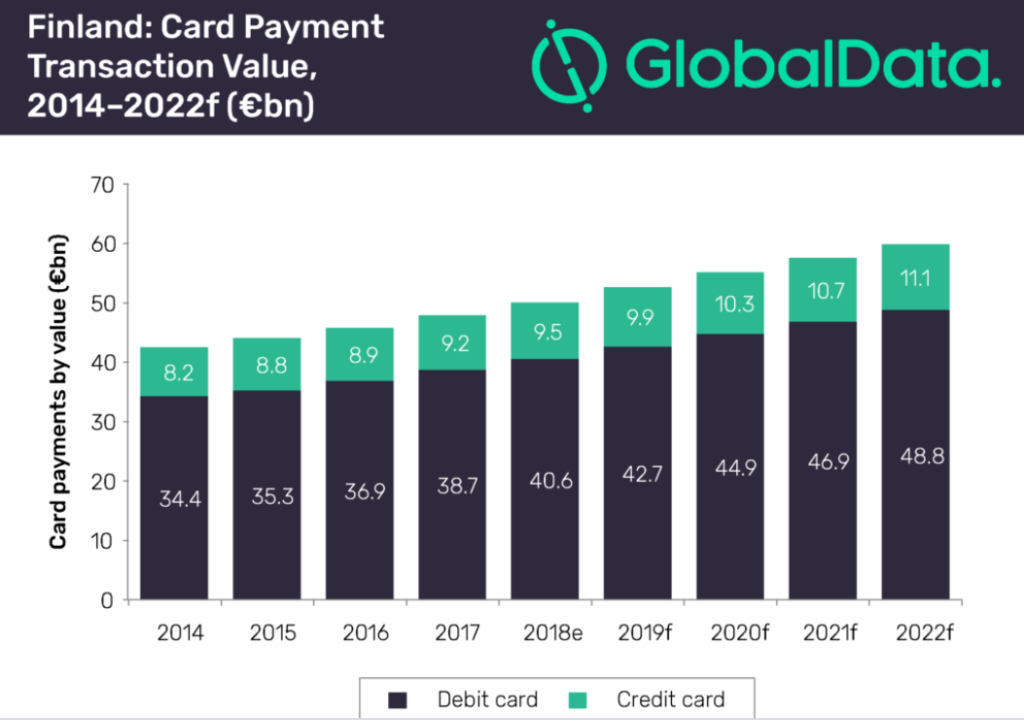

Leading payments data and analytics company GlobalData, in a 2019 report, announced that Finland is the country most-ready to go cashless. The country is currently second place in the use of cards and fifth in e-commerce spending as a percentage of GDP. It’s also third in regard to internet banking penetration and ranks second in smartphone penetration worldwide.

The country’s journey to a cashless society has been helped by the large population of banks, the growing awareness of electronic payments, and a well-developed e-payments infrastructure.

The GlobalData report, titled Payments Landscape in Finland; Opportunities and Risks to 2022, forecasts that the country’s volume of cards is set to register a CAGR of 4.6% up to 2022. Physical cash transactions, meanwhile, will see a CAGR of -0.8%.

The report goes on to say that payment cards have become an integral part of day-to-day financial operations in Finland, with at least 80% of Finns preferring to pay via debit cards at merchant outlets. In 2018, debit cards accounted for approximately 78% of all transaction value in the country. The country’s central bank predicts that Finland will become completely cashless by 2029.

Cashless payments in China

Outside Europe, China leads the pack in pursuing a cashless economy. Indeed, in a recent article published on Wealth Advisor, the writer postulates that the China that emerges from the coronavirus will likely be a cashless country.

Before the virus, the country already conducted more than 80% of all transactions through mobile apps. And, even if you go back a few years, in 2017, about 75% of all transactions in the country were accomplished through digital payments.

It’s estimated that 86% of the country’s consumers now use mobile payments. Whether it’s to make appointments at a hospital, pay utility bills, travel short or long distances, or buy items at the grocery, they pay through mobile.

The country has been investing heavily in technologies to make cashless payments a reality. Already, China has the most 4G base stations of any country (5.44 million). That’s about half of the world’s total. The country has also developed innovative QR codes as well as online and offline payment methods and gateways to make cashless payments convenient.

Others

Aside from Sweden, Finland, and China, other countries making deliberate efforts to go cashless include the UK, Australia, and South Korea.

Arguably the global capital of online banking, the UK, specifically London, is leading the charge in many fintech innovation areas. Mobile payments, for instance, are now standard in the city and the large majority of small merchants now prefer card payments. The country currently ranks second globally for e-commerce as a percentage of GDP, behind only China. Many experts foresee the UK becoming cashless in the mid-2020s.

Australia too isn’t left behind. The country is ranked 7th in terms of readiness to go cashless, with the government seriously gearing up to digitize most of its economy. Internet banking is predicted to reach almost 70% of the population by 2022.

Finally, South Korea is another nation to keep an eye on. Although countries such as China have been quicker in adopting cashless alternatives, South Korea has an even better cashless infrastructure. Moreover, more than half of the country’s 1,600 banks no longer accept cash deposits or withdrawals and many of the government institutions are now cashless.

Opportunities and Challenges

With cash going “out of fashion,” cashless alternatives are popping up everywhere. We’ve already mentioned the Swedish e-krona. There are multiple others that have come up recently. These include card payments, digital currencies (such as Bitcoin), and mobile wallets.

But, why cashless? Why are countries abandoning the banknotes and coins that have served them so well for the past century or so?

Advantages of Going Cashless

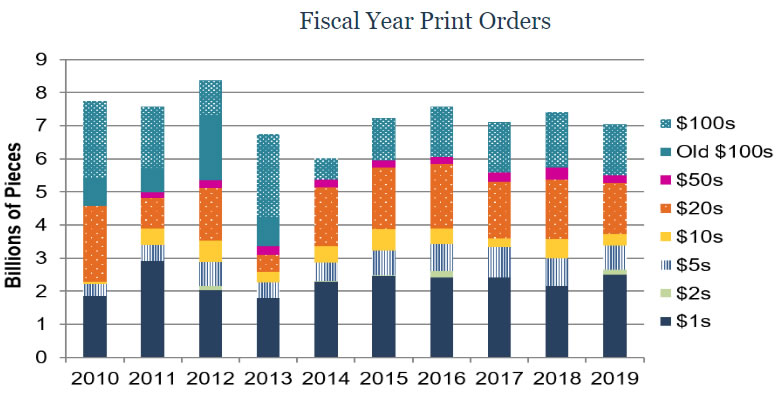

One of the biggest benefits of a cashless economy is that governments are able to save on the costs associated with printing banknotes and minting coins. Countries spend billions on printing notes. In the US, it costs 16.1 cents ($0.161) to print a $20 bill and about 19.6 cents ($0.196) to print a $100 bill.

Put together, the country is spending a whopping $877.2 million to print/mint currencies in 2020. Imagine what that kind of money would do!

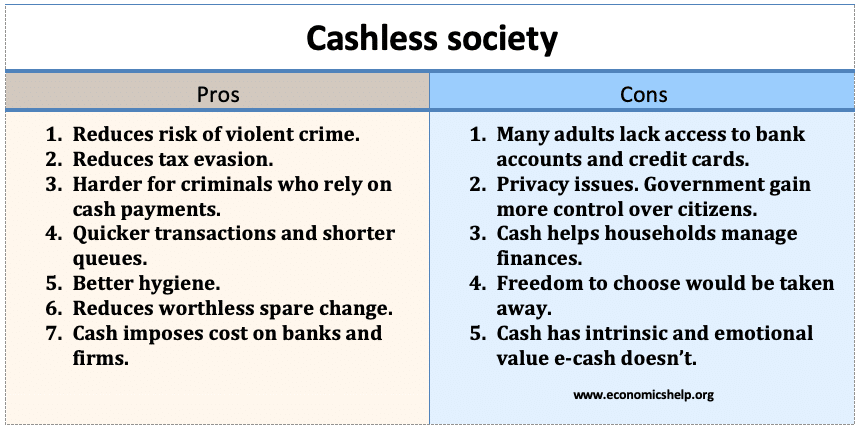

Aside from saving note printing & coin minting costs, going cashless is also beneficial to countries in the following ways;

1. It’s easier to track money

Financial crime would almost dry up in a fully cashless society. Unlawful transactions such as illegal gambling and drug trade would be dealt a huge blow. These illegal businesses rely heavily on cash transactions. Why? Because you can’t trace physical money. There’s no record of the transaction, which makes money laundering very easy.

Laundering becomes much harder in a cashless society where the source of funds is clearly identifiable. If you spend a few million in a casino somewhere in the Bahamas, the records will trace the transaction back to you. It also makes it very difficult to hide income and evade taxes because the records are there for the authorities to see.

2. Lower crime rates

The other advantage of a cashless society is reduced cash crimes. Currently, carrying cash makes you an easy target for criminals. You’ve seen the videos and read the stories of people being attacked immediately after withdrawing significant amounts of money at the ATM. Those thugs are motivated because they know it’s impossible to track the cash or prove that it was taken from someone else.

Going cashless changes the dynamics. First off, since the money is stored in mobile wallets, cards, and other digital forms, it’s much more difficult to steal. Secondly, if a criminal goes on to steal your card or mobile device and use it to withdraw your cash, there will be a paper trail, making it much easier to charge the culprit.

3. Easier international payments

Finally, think about what happens when you travel to another country. In many cases, you need to withdraw and convert large amounts of cash into the host country’s currency before you can buy or pay for anything. As we’ve already mentioned, this exposes you to thugs and criminal attacks. Additionally, if you can’t convert enough money, on time, you can’t pay your bills as you’d wished.

A cashless society completely eliminates this problem. First, you no longer have to worry about withdrawing bundles of physical cash just because you’re traveling. Secondly, you don’t need to exchange any money into a different currency. Lastly, the risk of a criminal attack is significantly reduced.

The Challenges

A cashless society won’t be without challenges, however. Indeed, some of the problems we’ve had with physical cash could only get worse when we go cashless. The following are some of the lessons learned from the near-cashless economies;

- Sacrifices privacy

The same people you trust to safely store your payments and personal data might hand it over to third-parties. Many financial companies, for instance, are known to trade consumer information with betting companies, loan institutions, and advertisers. In China, all the transaction information is available to the government.

Waking up to endless ads from an advertiser you didn’t give you’re your details isn’t something anyone enjoys. But, it gets worse, the data could end up in the wrong hands!

- Hacks are all too common

When the consumer’s personal data gets into the hands of hackers and other cybercriminals, the damage can be huge. These criminals will stop at nothing. Often, the first thing they’ll do is try to use the information to steal the consumer’s money. They can do this through phishing attacks, malware attacks, DDoS attacks, and ransomware attacks.

But, it’s not just that. Cybercriminals are also known to use personally identifiable information (PII) to blackmail and cyber-bully their targets.

Not There, Yet

In the end, you can see that we’re likely headed toward a cashless society. Within the next decade or so, a lot of the global population will move from physical cash payments to cards, mobile payments, and digital currencies, such as Bitcoin. Some countries will be completely cashless.

But, it’s also clear to see that we’re not there just yet. Even in countries that are cashless-ready, such as Sweden and China, challenges persist.

In China, for instance, in addition to privacy issues and hacking fears, access to cashless infrastructure is still a problem. Not everyone can use smartphones to make mobile payments yet. In Sweden meanwhile, there are a handful of people who don’t trust cashless payment options. They feel safer paying in cash. These people will need education and convincing if the Swedish society is to become 100% cashless.

Finally, the cashless revolution could also prove a burden for the developing economies, potentially holding everyone back for a while. In countries where putting food on the table is still a challenge, the question would be whether to invest in food sources or spend their budgets on cashless infrastructure. Not an easy question, right?