The devastating impact of the Covid-19 crisis on every-day life and health has carried a thoroughly disruptive economic fallout. Economists cannot revise their projections of growth down fast enough. Analysts anticipate that the total cost of the pandemic will have accumulated to a staggering $8.8 trillion by the end of 2020, which is almost nine percent of the global GDP.

An overwhelming number of measures have been developed to cushion the Coronavirus blow to the global economy. Yet, the path ahead remains precarious, thanks to epidemiological uncertainty and unpredictable shock to both supply and demand.

Meanwhile, “pre-existing conditions” in the economy that had long remained hidden are coming to light as major challenges. Organizations in virtually all industries are painfully accepting the reality that business will not return to normalcy any time soon. The remote and flexible work model has gradually become the new normal, boosting the number of people who choose to become self-employed freelancers and thus, the need for fixed price accountants and bookkeeping professionals.

The Covid-19 Impact on Banks

As Covid-19 continues to wreak havoc, banks undoubtedly have their hands full. Businesses are facing stagnated sales and declining profits, and individual borrowers are losing jobs. Consequently, banking customers are increasingly seeking financial relief.

Even as the world looks to banks for help, however, these institutions are not in the best position to be philanthropic. They too have to deal with the strained earnings and the rapid changes to banking habits that Covid-19 has brought.

Strained Earnings

The outlook of the financial market was positive during the first several weeks of the year, but things quickly took a tumble. When market stress started in February, bank stock prices plummeted. In March, a severe stock sell-off set in, and banks became the worst performers in the market. By the end of the quarter, banks’ stock prices were lower than those of some of the hardest-hit sectors. Price-to-book ratios fell to below one across banks in Europe and the U.S.

Banks have suffered immensely, not just relative to other sectors, but also when you compare this year’s pandemic to previous crises. Despite the recent improvement, the decline of stock prices is on par with the one that followed the 2008 collapse of Lehman Brothers. Long-term rating outlooks are deteriorating dramatically, and industry players are expressing concerns over the Covid-19 impact on bank earnings.

Meanwhile, indicators of banks’ funding costs have risen exponentially. In March, spreads on bank bond indices grew substantially across various maturities and currencies. Even after some decisive policy actions from the Federal Reserve and the European Central Bank, funding conditions remained tight all through May, with most spreads ranging around twice as wide as they were in February.

Challenged banking habits

The rapid spread of the Coronavirus got many institutions scrambling to reinvent their workspaces to minimize in-person banking and physical exchanges. When the World Health Organization advised against contact payment methods in March, the Bank of Korea responded by quarantining bills coming from local banks. Similarly, the U.S. Federal Reserve resolved to isolate banknotes from Asia for up to 10 days. In many parts of the world, disinfecting and isolating physical notes became commonplace.

Of course, Covid-19 has more carriers than just paper money. Banks, customers, and regulators have been weighing the risks of face-to-face transactions. Official recommendations from the CDC advise individuals to keep at least six feet away from visibly ailing people, a feat that could be impossible at physical branches.

Banks are therefore feeling the pressure to think outside the box and embrace new technologies and processes. Digital banking now seems like the most reasonable way to complete transactions.

In April, the Federal Financial Institutions Examination Council advised banks in the U.S. to test their system’s capacity to handle the anticipated influx of digital banking demands.

At a time when reducing operating costs is the top priority for all business organizations, institutions without the framework for remote banking are grappling with the fact that they must invest to satisfy their clients.

How Can Banks Survive The Covid-19 Scourge?

If you have any interest in the banking sector, you have probably been wondering what banks can do, both in the short and long term, to wade through the Coronavirus storm and play their part in sustaining the global economy.

Banks around the world are expected to be the stabilizing pillar for their customers, employees and economies. Essential services like deposits and withdrawals, credit extensions, and payment facilitation must not be disrupted.

Concurrently, banks must reassure their customers and retain their trust during this uncertain period.

Read on for the critical steps that banks must take to stay afloat and secure their post-Coronavirus future.

Stress-test existing systems

It is difficult to pin-point the exact financial impact of the Covid-19 crisis. Nonetheless, based on current indicators, the banking industry can safely anticipate some trends over the course of the year.

- Fee income will continue to fall, driven by lower customer spending, fewer assets being managed by banks’ asset-management divisions, and decreased investment-banking activity. Some trading businesses might be exceptions, as continued volatility will translate to more bid-ask spreads.

- Net interest margins will remain low and borrowing volumes may offset falling interests.

- Credit losses will continue to rise across most sectors, small businesses, and retail segments.

- Remote work will continue to necessitate more setup investment, particularly in the development of fraud-prevention measures.

To understand the impact that these trends will have on portfolio, banks need to apply rigorous testing tools and complement them with close monitoring. Before testing, however, they must first examine the performance assumptions that structure existing systems. The Covid-19 situation is unprecedented, and assumptions built into previous models may not hold.

Proper systems stress-testing will require banks to prioritize and iterate intelligently. They will need to identify the industries and segments that present opportunities or are most vulnerable, and quickly analyze data to identify warning signs in time. This base will enable them to build a more comprehensive view of the economic landscape as the pandemic evolves and respond accordingly.

Additionally, reverse stress-tests will enable banks to lay out hypothetical scenarios that represent actual occurrences more accurately. These scenarios must, however, be based around the potential spread of the virus and the corresponding human reaction as the situation progresses.

Analyzing the preempted changes in supply and demand chain will be particularly complex due to the lack of a direct historical precedent. Historically linked factors like employment and income could decouple, while previously decoupled variables like global business continuity plans might get more correlated.

When building scenarios, banks must factor in the implications of short-term measures. Most institutions have reacted quickly and appropriately to try and contain virus spread. These measures will likely have to remain in place for several months, and if they do, their impact on the bottom line may need to be re-evaluated.

Develop sustainable Workforce Measures

A survey by Gartner HR highlighted that 88 percent of organizations in the U.S. have encouraged or required staff to work from home. Banks themselves have shrunk operating hours and reduced the number of customers they can serve at a time because of social distancing rules.

That said, sustainable health measures take months, not days or weeks. Banks need to ensure the steps they have taken are sustainable. They must be designed to get the most productivity from employees while preserving both their mental and financial well-being.

Banks provide essential services to customers and communities. Therefore, they need a workforce management framework that is based on service criticality and exposure risk. Keen attention is required for workers that provide critical customer-facing services or require infrastructure that is only available at work premises.

Trading activities, for instance, are crucial for market operations but technology and compliance requirements make it difficult to conduct them remotely. Most banks have already implemented measures like segregating employees and activating business continuity plan sites. To cope with a prolonged crisis, however, banks may need to consider alternatives that do not suffer the capacity constraints of BCP sites.

Furthermore, because of the high probability of simultaneous infection across BCP sites, banks must maintain backup plans in the event of infection at or in the vicinity of a site. These backup plans could include; the readiness to move to a work-from-home model on short notice, for which the technology and regulatory clearance needed must occur preemptively.

For the employees that can work from home, banks need to tailor their policies, practices, and controls to the new working environment. Technological requirements and output-based performance management must particularly be in focus. Meanwhile, both the internal tech support and employee relations must be adequately staffed and trained to accommodate many new requests.

Reassure their customers

Banks have experienced a significant increase in the number of customers filing queries on a typical working day. Clients are frantically reaching out to their banks with questions, concerns and requests. Meanwhile, staffing shortages and limited operating hours in call centers have resulted in longer waiting times, further fueling the disgruntlement.

Banks must provide their customers with the digital tools required to ensure non-disruptive banking to cope with this challenge. According to BAI, more than 95 percent of banks in the U.S. were keen on investing more in digital banking at the beginning of the year. In light of recent events, you can reasonably assume that the emphasis on digital banking has increased. An omnichannel experience that enables navigation across multiple devices and direct connection to bank systems can help shift traffic from physical to remote channels.

Through these remote channels, banks would need to offer some self-service features. Clients can accomplish tasks like submitting documents, opening accounts, managing balances, initiating transactions, executing payroll, and even printing checks, all online.

By minimizing the need for customers to visit physical branches, banks would offer better customer experience while reducing the costs and errors that come with frequent manual intervention.

Finance the global supply chain

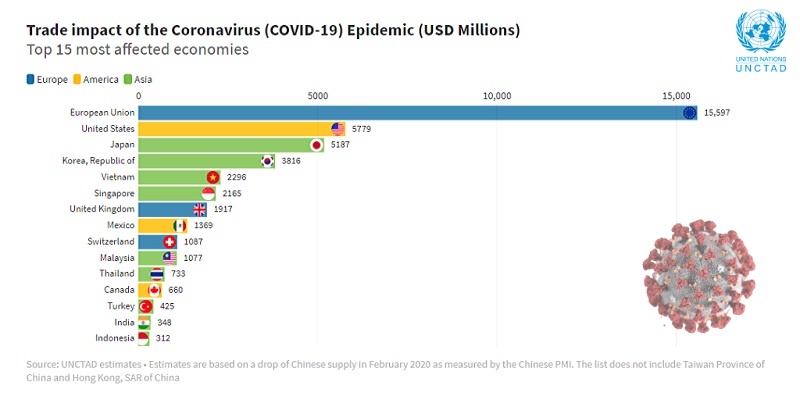

For most companies, one of the most pressing concerns of the Covid-19 pandemic has been its impact on supply chains. A D&B report on the pandemic’s impact on business performance, 938 of Fortune 1000 companies have suppliers that have been affected by the crisis. UNCTAD estimated that the impact of the virus cost global supply chains $50 billion in exports in February alone.

Most supply chain partners of corporations are small and medium enterprises, and they have been hit the hardest because of higher vulnerability levels and lower resilience. Governments and industry players have introduced various incentives for this segment, but problems still persist. Businesses are struggling with the eligibility criteria for government-backed loans and many have to contend with high-interest rates. Additionally, many institutions are prioritizing customers with whom they have existing relationships, leaving out many vulnerable businesses.

Admittedly, the stringent selection criteria and high-interest rates are warranted by the banks’ valid concerns about the sustainability of SMEs during the crisis. Nevertheless, with supply chains becoming increasingly localized, supply chain finance could be a gold mine for lenders in the current times.

Banks can collaborate with their anchor customers to offer loans to SMEs. So, rather than hinging a transaction to the supplier’s creditworthiness, a bank can deal with the corporate customer that is typically more fiscally sound. It is a win-win scenario, where corporates can pay the banks later rather than tying up their liquidity now. And suppliers can get the money they need to fulfill immediate obligations.

Prepare for increased cyber-crime

Following the influx of digital transactions, many regulators have published warnings about an increase in cyber attacks and fraudulent activity. Home networks are generally less secure than workplace networks, and the stress caused by the pandemic have made workers more vulnerable. Moreover, fraudsters are always keen to exploit new systems whose users are yet to grasp fully.

Studies show that the most significant financial losses due to cybercrime happen through Business Email Compromise (BEC). In this approach, criminals take over a senior executive’s email account and instruct a staff member to wire money to an overseas account. The Federal Bureau of Investigations has warned that an increased number of remote workers presents more opportunities for BEC fraud.

As the banking sector settles into work-from-home arrangements, institutions must ensure that their systems have foolproof anomaly detection tools. This will help check and automatically trap any urgent or unusual payment requests, be they changes to account details or strange payment amounts. These tools can also help in catching duplicate transactions caused by malicious activity or connectivity breakdown.

Support households and businesses

Numerous households and businesses have been negatively affected by Covid-19 and the measures implemented to curb its spread. In the U.S., 74 percent of workers are living from paycheck to paycheck, and 58 percent are paid hourly. For this segment, the combined financial impact of reduced sector activity and quarantine measures is grave.

Among businesses, the effects vary significantly from one sector and company to another. Industries like travel, tourism, entertainment, oil and gas, and automotive are on their knees because of disruptions in supply and demand. Within these sectors, small businesses, particularly those that cannot move to remote work or online deliveries, are the most affected.

From a credit perspective, banks need to quickly identify the most impacted sectors and understand how they can support them. Some institutions have already implemented relaxed payment schedules and adjusted risk-mitigation actions for delinquencies and non-performing exposures. By supporting clients in this crucial time, banks can strengthen customer relations and reaffirm their role as key pillars of the economy.

Enduring Covid-19: Only the most transformative will survive

As cash gatherers, credit givers and payment facilitators, banking institutions are a lot more than mere commercial enterprises. By providing these essential services to individuals, organizations, and communities, banks are the cornerstone of a functioning economy. Therefore, their financial well-being, the health of their workforce, and the continuity of their operations are crucial.

The financial crisis of 2008 brought about much emphasis on the systemic risks associated with banks. The ongoing one, whose origin is entirely outside the banking system, offers banks the opportunity to finally prove themselves as stabilizers that can provide economic and social support.

As they fulfill their crucial role, banks must bear in mind that the Coronavirus pandemic is likely to reinforce some of the trends that were already gaining traction. Factors like workplace dynamics and talent management were already evolving in the digital age, and they may be permanently disrupted after an extended period of working remotely.

Banks need to consider this crisis as a testing ground for their existing systems and draw implications for their organizational and cultural transformations. They will also benefit from keeping tabs with the changes in customer routines and expectations. Areas such as new service demands, digital adaptation, and expectation for proactive communication needs be to given serous thoughts.

Covid-19 is throwing all sectors on the chopping board. For banks to survive the storm, they must carefully look to the lessons that the current situation presents and use them to inform their strategy for transformation, all while developing an elevated level of operational and financial resilience.