An announcement by the Federal Reserve to keep the fed rate near zero should support the short-term borrowers during the pandemic, reported CNBC Thursday.

Earlier on Wednesday, Federal Reserve declared that it will keep the interest rates down to reverse the economy from the Covid-19 pandemic. Moreover, the central bank also had a plan to run higher inflation in a major policy shift last month.

“Interest rates are extraordinarily low and they are going to stay that way for a long time.”

– Laura Veldkamp, professor of finance and economics at Columbia University Business School.

All this will help the borrowers to gain temporary cheap money until the next rate hike happens in the future.

However, the fed rate is not the interest rate for the consumers and affects the borrowing rates significantly.

- Related Stories: Federal Reserve Might Announce a Major Policy Shift for a Broader Economy

- Related Stories: Cryptocurrency Savings Account: How this can Disrupt the Banking System?

Lower Fed Rate Is a Blessing for the Borrowers

We all know how the Coronavirus pandemic changed businesses around the world. Many of them were closed down permanently forcing 50 million people out of the workforce, according to the visual capitalist.

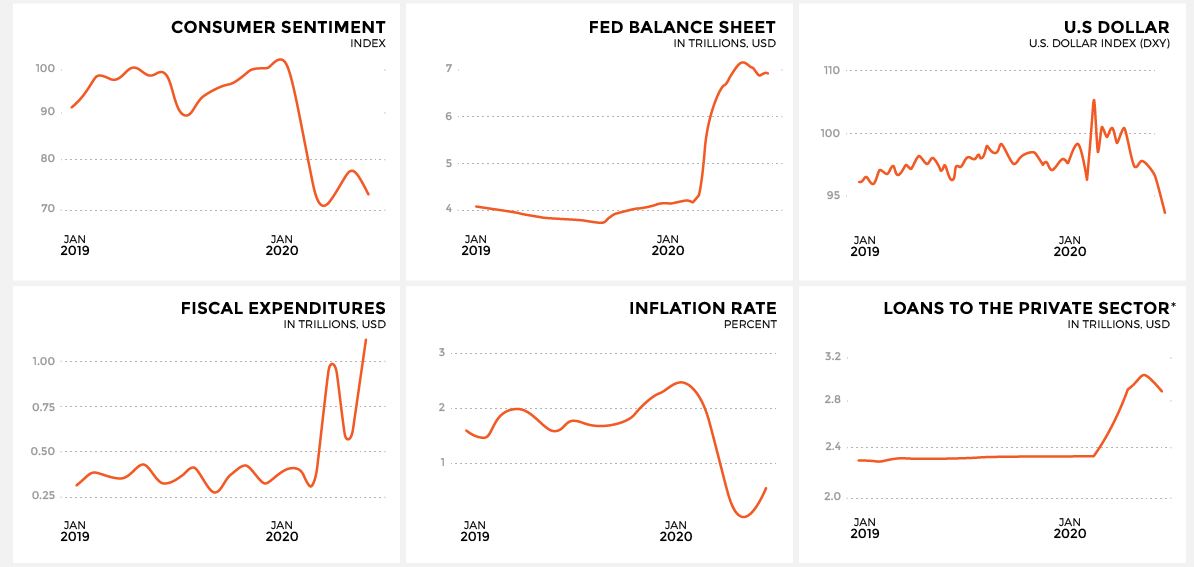

The money supply increased rapidly breaking the fed balance sheet records. Most significantly, the rate of Covid-19 infection made it the third most common cause of death just after accidents in the U.S.

Amid the entire situation, the positive impact of lowering the fed rate can be seen on credit cards, personal loans, and home loans. Already credit card rates are down from a high 17.85% to 15.99%, reported Bankrate.

The personal loans are around 12.08% and home equity lines of credit are 4.56%. Student loans, on the other hand, are cheaper as well, according to the CNBC news.

For the borrowers seeking private loans can also be benefited if fed rates are down.

The private loans are generally tied to LIBOR, prime, or T-Bills. However, keeping the rate low is not a good sign for everyone.

“Savers got kicked in the shin,” said Greg McBride, Chief Financial Analyst at Bankrate.

An indirect correlation between the fed rate and savers rate means savings accounts will get less. In addition, higher inflation will also decrease purchasing power over time.

Read More: Walmart is Testing a New Drone Delivery System for Household Items